RAK Offshore Company Setup

Lowest Price Guaranteed

Over 12,500 Customers Satisfied

Top Registered Agent with RAK ICC

12,500+

Clients

32,000+

Consultations

5+

About RAKICC and RAK Offshore

What is RAKICC & Its Role in Offshore Business Setup in RAK?

The RAK International Corporate Centre (commonly known as ‘RAKICC’ or ‘RAK ICC’) is a government corporate registry based in the Emirate of Ras Al Khaimah, United Arab Emirates. RAKICC is pivotal in the registration and formation of international business companies and offshore companies in the UAE. It offers a comprehensive suite of registration services tailored to offshore business setup.

RAKICC was established through Decree No. 12 of 2015, later amended by Decree No. 4 of 2016, which merged the RAK International Companies (formerly part of RAK Free Trade Zone) and RAK Offshore (previously under RAK Investment Authority). RAKICC is renowned for its modern, world-class offshore company registration services and adheres to international best practices, earning it a strong reputation as a leading authority in UAE offshore company registration.

What Are the Benefits of an RAK Offshore Company in the UAE?

RAKICC offers numerous advantages for offshore business setup, including:

- Bank Account Opening: Offshore companies can open bank accounts in their name.

- Property Ownership: You can own real estate in Ras Al Khaimah and Dubai through an RAK offshore company.

- 100% Foreign Ownership: Enjoy complete foreign ownership without the need for a local partner.

- Share Ownership: RAK offshore companies can own shares in both mainland and free zone companies within the UAE.

- Tax Benefits: Offshore companies benefit from zero taxes on income and profits.

- Subsidiary Establishment: You can establish a subsidiary within the RAK Economic Zone.

- Legislative Framework: RAKICC provides a robust and modern legislative framework, making it a reliable jurisdiction for offshore company setup.

- Compliance Procedures: RAKICC maintains stringent compliance procedures to ensure the integrity of offshore business activities.

What is RAK Offshore or RAK IBC?

RAK Offshore, also referred to as RAK IBC (International Business Company), is a term used to describe an offshore company registered with RAKICC in Ras Al Khaimah. Prior to the consolidation of corporate registries in 2016, RAK Offshore operated independently as part of RAK Investment Authority.

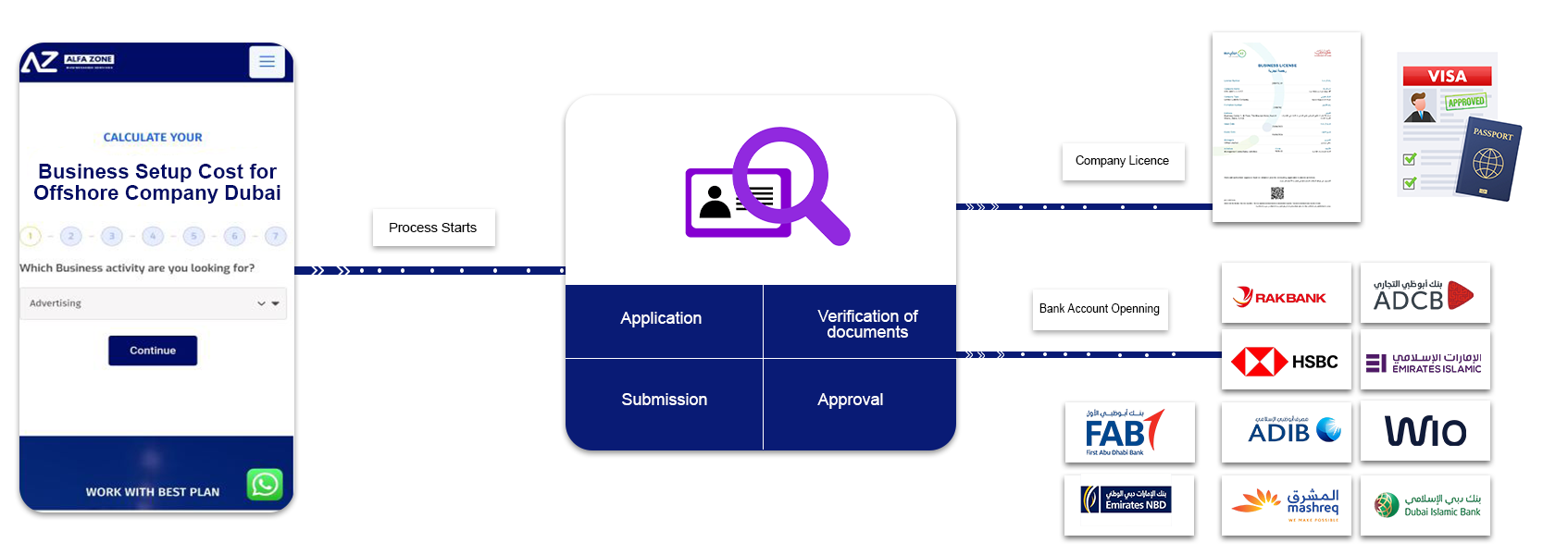

3 Simple Steps

Setting Up your Offshore business in RAK explained in three (3) simple steps

CALCULATE YOUR COST

for Setting up your Offshore Business in RAK

Our Exclusive Packages

Get in touch with one of our experts to know about the costs of RAK Offshore business setup.

Other Options

Other Options you maybe interested to set up your business in Dubai and UAE

Meydan Free Zone

- Free zone based in Dubai

- Up to 49 shareholders

- Professional, commercial, and industrial license

Dubai Mainland

- Access to Local Market

- 100% Foreign Ownership

- Flexibility in Office Location

RAKEZ

- Free zone based in Ras Al Khaimah

- Up to 5 shareholders

- E-commerce, professional, media, and other types of licenses

IFZA

- Free zone based in Dubai

- Up to 3 shareholders

- Professional, commercial, and industrial license

Process

Step by step process of business setup in Dubai

Ultimate Beneficial Owner (UBO) Declaration for RAK Offshore Companies

The UAE Government issued Cabinet Decision No. (58) of 2020 on August 24, 2020, concerning beneficial owner procedures (“Cabinet Decision”), which applies to RAK offshore companies. This mandates that RAK offshore companies must declare information about Ultimate Beneficial Owners (“UBOs”) to the Ras-Al-Khaimah International Corporate Centre (RAK ICC).

Failure to file UBO information can result in penalties of up to AED 100,000 for RAK ICC companies. Here, we address key questions related to UBO declarations for RAK offshore companies.

Who is a UBO?

- A UBO is any individual who ultimately benefits from a company.

- A UBO has ultimate control over a business, either through direct or indirect ownership of at least 25% of the company’s shares and voting rights.

- UBOs can appoint or dismiss directors/managers and have significant influence over the company.

What does the UBO declaration consist of?

- Names of directors/managers acting under another person’s instructions.

- Information about partners and shareholders, including their voting rights and the date they acquired ownership.

Who should declare UBOs?

- All companies in the UAE, whether registered on the mainland, free zones, or offshore, must declare their UBO information.

- RAK offshore companies must disclose UBO details to RAK ICC, even if they operate outside the UAE.

Where to file UBO details?

- UBO information must be declared to the relevant offshore registration authority, which for RAK offshore companies is the RAK ICC.

What to include in the UBO declaration?

- Identification details: name, nationality, date/place of birth, and address.

- Identity card details: country of issuance, date of issuance, and expiry date.

- Date and basis of becoming a UBO.

- Date of ceasing to be a UBO, if applicable.

- Any amendments to UBO, shareholder, or director information must be reported to RAK ICC within 15 days.

Importance of UBO disclosure

- Transparency and Accountability: The Cabinet Decision aims to bring transparency and accountability to business transactions in the UAE.

- Prevention of Financial Crimes: Prevents crimes like money laundering by ensuring legitimate money flows and revealing ultimate beneficiaries.

- Legal Compliance: Avoids violations of UAE laws and protects the UAE economy.

Penalties for Non-Compliance

- Failure to declare UBO details within deadlines can result in penalties from the Ministry of Economy, UAE.

- Penalties escalate with repeated violations:

- First violation: written warning.

- Second violation: fines.

- Third violation: fines and possible suspension of the company’s license.

- Specific penalties include:

- Not maintaining a UBO register: fines up to AED 100,000 and license suspension for at least 12 months.

- Not maintaining a partner/shareholder register: fines up to AED 100,000 and license suspension for at least 12 months.

- Failing to provide additional requested information: fines up to AED 10,000 and license suspension for at least one month.

How can Alfa Zone help?

- Alfa Zone assists with company formation and compliance for RAK ICC companies.

- Our lawyers specialize in UBO declaration laws and can help ensure timely filing of UBO data.

- Contact us for assistance with your RAK ICC company’s UBO filing.

Benefits of UAE Economic Substance Regulations for RAK Offshore Companies

Understanding the UAE Economic Substance Regulations (ESR):

- The UAE has implemented the Economic Substance requirements of the OECD and the European Union Code of Conduct Group on Business Taxation.

- The introduction of the Economic Substance Regulations (ESR) ensures that the UAE is fully compliant with international tax commitments on cooperation.

- As a result, the UAE is now on the ‘whitelist’ of the European Union, a distinction held by very few offshore jurisdictions.

Compliance Requirements:

- According to the UAE Cabinet of Ministers Resolution No. 31, all businesses established in the UAE, including offshore companies, conducting any Relevant Activities must maintain a certain economic presence in the UAE.

Relevant Activities Under ESR:

- Banking Business

- Insurance Business

- Investment Fund Management Business

- Lease-Finance Business

- Headquarters Business

- Shipping Business

- Holding Company Business

- Intellectual Property Business (IP)

- Distribution and Service Centre Business

Popularity of RAK Offshore Companies:

- The implementation of the ESR has boosted the popularity of RAK ICC as a premier offshore jurisdiction.

- RAK ICC offers robust support and infrastructure to help offshore companies meet economic substance requirements.

- This includes setting up subsidiaries through RAKEZ free zone, opening branch offices, and utilizing outsourcing solutions.

Redomiciliation to RAK ICC:

- Many companies from other offshore jurisdictions are migrating to RAK ICC to comply with ESR requirements.

- Companies maintain their legal status and operational and banking history during this redomiciliation process.

- This shift is driven by changing shareholder priorities and the desire to meet ESR requirements effectively.

Competitive Advantage:

- RAK ICC benefits from being in the UAE, which is fully compliant with the economic substance requirements of the EU and OECD.

- The UAE’s compliance gives RAK ICC a significant competitive advantage over jurisdictions on the EU blacklist.

Jurisdictions on the EU Blacklist (as of February 27, 2020):

- American Samoa

- Cayman Islands

- Fiji

- Guam

- Oman

- Palau

- Panama

- Samoa

- Seychelles

- U.S. Virgin Islands

- Vanuatu

Frequently Asked Questions

Here are the most frequently asked questions regarding Offshore company setup in RAK.

- Tax Efficiency: RAK offshore companies benefit from no personal or corporate taxes.

- Asset Protection: Enhanced confidentiality and protection of assets.

- Ease of Setup: Simple and quick incorporation process with minimal documentation.

- Full Ownership: Foreign investors can have 100% ownership of their RAK offshore company.

- Global Business Opportunities: Flexibility to conduct international business and open bank accounts globally.

- Minimum Shareholder Requirement: At least one shareholder is required.

- Director Requirement: At least one director (can be the same as the shareholder).

- No Physical Office Needed: Offshore companies in RAK are not required to have a physical office in the UAE.

- Registered Agent: Must appoint a registered agent approved by the RAK ICC.

- Capital Requirement: No minimum capital requirement for offshore companies.

- International Trade: Conducting trade activities outside the UAE.

- Holding Company: Holding assets and shares in other companies.

- Professional Services: Offering consultancy and professional services globally.

- Investment Activities: Managing and investing funds in various assets and securities.

- Intellectual Property: Holding and managing intellectual property rights.

- Relevant Activities Compliance: Companies conducting Relevant Activities must meet the economic substance requirements.

- Reporting Obligations: Required to file ESR notifications and reports if conducting Relevant Activities.

- Economic Presence: Must demonstrate substantial economic presence in the UAE related to their activities.

- Non-Relevant Activities: Companies not conducting Relevant Activities are exempt from ESR compliance.

- Yes, RAK offshore companies can open bank accounts in the UAE, although it may require meeting specific bank criteria.

- Global Banking: They can also open bank accounts in other jurisdictions worldwide.

- Required Documentation: Typically, banks will require incorporation documents, proof of identity for shareholders and directors, and business plans.

- Banking Support: RAK ICC offers support and guidance in opening bank accounts through its network of banking partners.

Join 7500+ Happy Customers WorldWide

What Our Valued Customers Say About Us

Excellent

reviews on

Excellent

reviews on

Why Business Setup in UAE?

Maximize your earnings with the UAE’s 0% income tax policy.

- Repatriate 100% of your capital and profits to your home country.

- Capitalize on the growing market demand spurred by Expo 2020.

- Enjoy customs duty exemptions on imports and exports.

- Leasing office space might not be necessary, depending on the zone.

- Experience minimal paperwork and auditing requirements.

- Access new markets across the Middle East, Africa, Europe, and Asia.

- Full company ownership & easiest online processes.

Get A Reply In 60 Seconds

Our Network

Authorized Channel Partners