JAFZA Offshore Company Setup

Lowest Price Guaranteed

Over 12,500 Customers Satisfied

Top Registered Agent with Jebel Ali Free Zone

12,500+

Clients

32,000+

Consultations

5+

About Jebel Ali Offshore Companies

Where are Jebel Ali Offshore Companies Registered?

- Jebel Ali offshore companies are registered with the Jebel Ali Free Zone Authority (JAFZA), located in the Emirate of Dubai, United Arab Emirates.

- Jebel Ali Free Zone (JAFZA) is the oldest and most respected free zone in Dubai UAE, following a mature legislative framework and international best practices for setting up free zone and offshore companies.

- Like other offshore jurisdictions, JAFZA maintains confidentiality for the details of shareholders and officers of the company.

Ideal Uses for Jebel Ali Offshore Companies:

- Property Holding in Dubai

- Asset Protection

- Consultancy

- Trading

- Tax Planning

- Estate Planning

Features of Jebel Ali Offshore Companies:

- Oldest and most respected free zone

- No Taxation

- 100% Foreign Ownership

- Can own shares in UAE companies

- No Paid-up Capital Required

- No Accounting and Audit Requirements

- No restrictions on nationalities

- Can hold property in Dubai

- Bank Accounts in the UAE and internationally

- No limit on capital expatriation

- Registered address in Dubai

Activities Not Permitted for Jebel Ali Offshore Companies:

- Financial services

- Insurance and re-insurance

- Media activities

- Aviation activities

- Conducting business with onshore companies in the UAE

- Establishing a branch in the UAE

Activities Allowed for Jebel Ali Offshore Companies:

- Holding company activities

- International trade

- Consultancy services

- Brokerage activities

- Holding intellectual property rights

- Online advertising activities

- Registration of ships

- Trading in stock markets

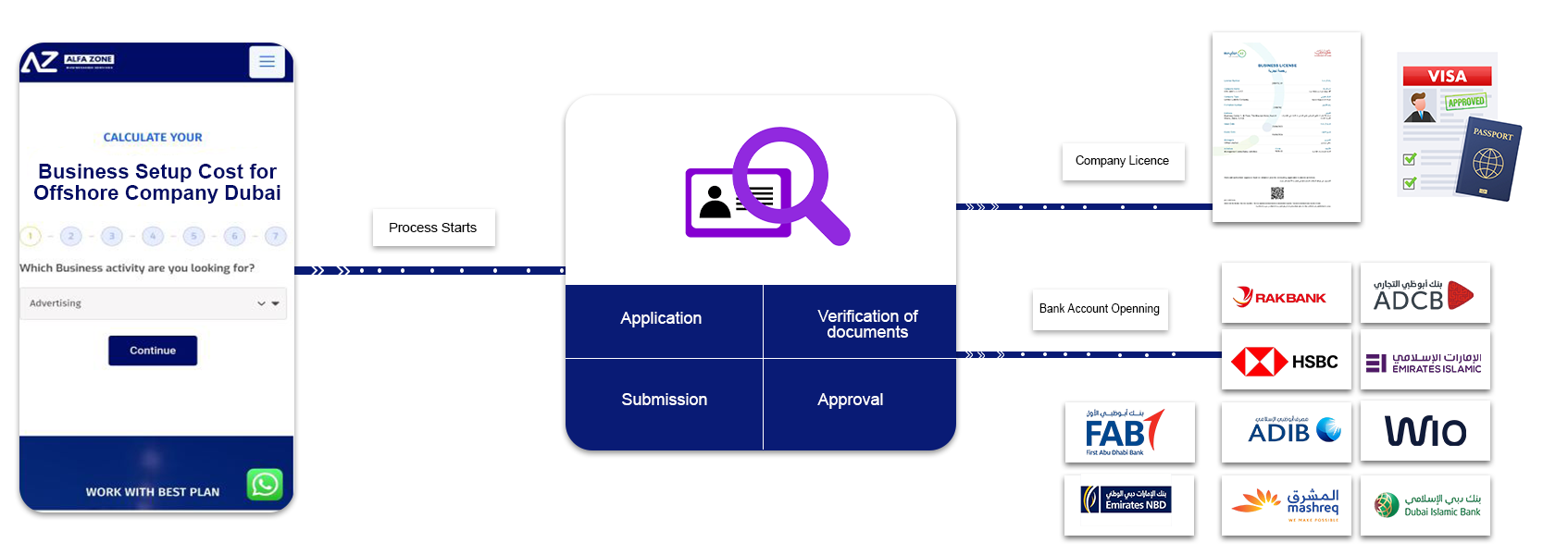

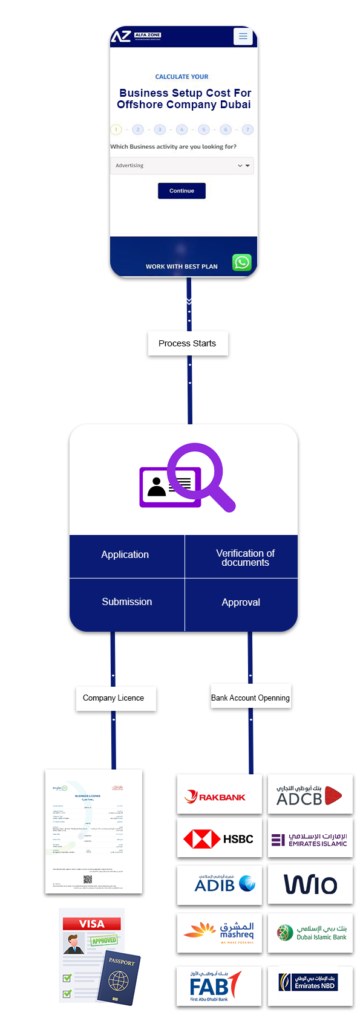

3 Simple Steps

Setting Up your Offshore business in Jebel Ali explained in three (3) simple steps

CALCULATE YOUR COST

for Setting up your Offshore Business in Jebel Ali

Our Exclusive Packages

Get in touch with one of our experts to know about the costs of Offshore business setup in Jebel Ali

Other Options

Other Options you maybe interested to set up your business in Dubai and UAE

Meydan Free Zone

- Free zone based in Dubai

- Up to 49 shareholders

- Professional, commercial, and industrial license

Dubai Mainland

- Access to Local Market

- 100% Foreign Ownership

- Flexibility in Office Location

RAK Offshore

- 0% Income Taxes

- International Business Operations

- Business Expansion and Diversification

IFZA

- Free zone based in Dubai

- Up to 3 shareholders

- Professional, commercial, and industrial license

Timeline

Step by step process of offshore business setup in Dubai

On the first day, we will reserve the name of your offshore company based on the three preferred names you provide. Additionally, we will prepare the necessary documents for your new offshore company, including the application form for company formation.

Once the company documents have been signed by you, we will proceed with submitting the documents to Jebel Ali Free Zone Dubai for the registration of your new Jebel Ali offshore company. The prescribed time frame for the registration of the company at this stage is approximately 1-2 working days.

You can begin the process of opening a corporate bank account for your offshore company. This process may take between 5 to 15 days or longer, depending on your specific case. To open your corporate bank account, you must meet the requirements set by the relevant bank.

Frequently Asked Questions

Here are the most frequently asked questions regarding Jebel Ali Offshore company formation.

Benefits include 100% foreign ownership, no taxation, no audit requirements, confidentiality of shareholder and officer details, ability to hold property in Dubai, and ease of setting up with minimal requirements.

The setup process typically takes 2-3 weeks, depending on the completeness of the required documentation and the approval process.

Requirements include at least one shareholder, one secretary, and two directors (the shareholder can also act as the secretary and one of the directors). No paid-up capital is required.

Yes, Jebel Ali offshore companies are permitted to hold property in designated areas in Dubai.

Yes, offshore companies cannot engage in financial services, insurance and re-insurance, media activities, aviation activities, conduct business with onshore companies in the UAE, or establish a branch in the UAE.

Yes, offshore companies can open bank accounts in the UAE as well as internationally.

Yes, JAFZA maintains strict confidentiality for the details of shareholders and officers of offshore companies.

Allowed activities include holding company activities, international trade, consultancy services, brokerage activities, holding intellectual property rights, online advertising, registration of ships, and trading in stock markets.

Join 7500+ Happy Customers WorldWide

What Our Valued Customers Say About Us

Excellent

reviews on

Excellent

reviews on

Highly recommend Alphazone Businessmen, especially if you want trustworthy and efficient service!

I highly recommend Alfazone and especially Tonisha to anyone looking for reliable and efficient business setup services in the UAE.

Thankyou ALFA ZONE & specially to SONIYA SHRESTHA.💕💕💕

I would like to recommend Alfa Zone to others and to my friends who need a help to open a trade licence with visa8.purely it is their service but it consist of more clarity and time bound.

The Team Alfa zone is well appreciated due to their response to call and my sincere thanks to Ms Tonisha who assigned to my work.

Really worth going and we can refer to others.in one word 👌 PERFECT.

However, we are deeply disappointed with the service we received after her departure. Unfortunately, the level of support and responsibility significantly declined. Due to the negligence of the current team, especially in handling the deregistration of our business, we faced serious complications that resulted in unexpected costs and stress — all of which could have been avoided with proper follow-up and accountability.

It is extremely disheartening to experience such a drastic drop in service quality. What should have been a straightforward process turned into a frustrating and costly ordeal. We trusted Alfazone to manage our business needs professionally, but sadly, they fell short.

We hope the management takes this feedback seriously and improves their internal processes to prevent other clients from facing similar issues.

A special thanks to Ms. Soniya for her outstanding assistance. Her approachable nature, professionalism, and ability to offer the most suitable options made the process much easier.

She has the patience to explain all our needs any number of times.really Ms Sonia is a asset for your company

I highly recommend this company — an excellent business setup service like no other. I got my Trade License for PRESTIGE PICK GENERAL TRADING FZ-LLC with their help.

Special thanks to Miss Soniya, who has been incredibly supportive from the very beginning and continues to assist me. She expedited both the license and visa application exactly as I requested. Truly professional and efficient service!

A huge thank you to the AlfaZone Dubai team for making my company setup in the UAE such an easy and hassle-free experience. From paperwork to guidance, their support was top-notch. I’m truly grateful for their exceptional service and highly recommend them to anyone looking to establish a business here.

Harima Bizal, a fellow Filipino, guided me every step of the way. Even though I had zero knowledge at the start, it wasn’t a problem at all—she explained everything clearly, was extremely patient, and supported me throughout the whole process. If you're looking for someone reliable, especially if you're Filipino, Harima is the one to go to! Highly recommended!

I would like to specifically commend Ms. Harima for her exceptional assistance. She was not only approachable and easy to deal with, but she also provided the best options tailored to my needs. Her proactive approach in providing prompt updates without needing to ask was particularly impressive.

Thank you for your outstanding service. I look forward to continuing my business relationship with Alfa Zone.

We want to give a special shoutout to Ms. Maricon for her exceptional support. She was proactive in keeping us informed and helped guide us through the entire transition with great care and attention to detail.

In addition, the CEO went above and beyond to help us cancel our old license. Alfa Zone has proven to be a trustworthy and supportive partner, always there when we needed them.

We wholeheartedly recommend Alfa Zone Businessmen Services to anyone looking for assistance with their business setup. Their professionalism, reliability, and excellent communication make them truly outstanding.

A big thank you to Ms. Maricon, Mr Suren, and the entire team for their exceptional service. Great job!

Why Business Setup in UAE?

- Repatriate 100% of your capital and profits to your home country.

- Capitalize on the growing market demand spurred by Expo 2020.

- Enjoy customs duty exemptions on imports and exports.

- Leasing office space might not be necessary, depending on the zone.

- Experience minimal paperwork and auditing requirements.

- Access new markets across the Middle East, Africa, Europe, and Asia.

- Full company ownership & easiest online processes.

Get A Reply In 60 Seconds

Our Network

Authorized Channel Partners

Ready To Start Your Business in Dubai?

Working Hours

Monday – Saturday

9:30am – 6:30pm

©2024. AlfaZone. All Rights Reserved.