Mainland Company Formation in Dubai

Lowest Price Guaranteed

Over 12,500 Customers Satisfied

Top Registered Agent with Dubai Mainland

12,500+

Clients

32,000+

Consultations

5+

About Department of Economic Development Dubai

What is the Department of Economic Development?

- The Department of Economic Development (DED) is the authority responsible for issuing trade licenses for businesses operating in Dubai mainland.

- According to Law no. 13 of 2011, the DED regulates economic activities for all businesses outside the free zones.

- The DED aims to ensure economic growth and effective policy implementation in Dubai.

- It works towards achieving the government’s vision for the expansion and development of various economic sectors.

We collaborate closely with the DED to support the economic goals set by the government, offering hassle-free corporate services and simplifying the process of business setup in Dubai mainland.

What is a Mainland Company?

- A mainland company is licensed by the DED of the relevant Emirate and can conduct business anywhere in the UAE.

- Often referred to as an ‘onshore’ company, a mainland company in Dubai is highly sought after.

Benefits of a Mainland Company in Dubai:

- Flexibility: Conduct business activities in both local and foreign markets.

- Unlimited Visas: No restriction on the number of visas issued for the company.

- Office Location: Premises can be based anywhere in mainland Dubai.

- Visibility: Greater accessibility and brand visibility.

- Government Contracts: Access to government tenders, as government departments typically do not engage with free zone companies.

Main Licensing Options Under Department of Economic Development:

Commercial License:

- Issued as a Limited Liability Company (LLC) for any commercial activity in Dubai.

- The most common commercial entity for mainland business setup.

Professional License:

- Issued for services, skills, and expertise of the individuals conducting the business.

- The company can be a sole establishment or an LLC.

- A foreign national can establish a sole establishment under their own name, except for some activities.

- A UAE national is required as a local service agent for a sole establishment.

Branch Office:

- A branch office license is an extension of a local or foreign company.

- It does not have a separate legal personality and can only carry out the business activity of the parent company.

- Special approval is required from the UAE Ministry of Economy.

- A UAE national must be appointed as a local service agent.

Representative Office:

- Primarily set up to promote the business and expand the accessibility of the parent company.

- A UAE national must be appointed as a local service agent.

3 Simple Steps

Setting up your business in Dubai Mainland explained in three (3) simple steps

CALCULATE YOUR COST

for Setting up your Business in Dubai Mainland

Our Exclusive Packages

Get in touch with one of our experts to know about the costs of business setup in Dubai Mainland

Other Options

Other Options you maybe interested to set up your business in Dubai and UAE

IFZA

- Free zone based in Dubai

- Up to 3 shareholders

- Professional, commercial, and industrial license

Meydan

- Free zone based in Dubai

- Up to 49 shareholders

- Professional, commercial, and industrial license

SPC Free Zone

- Full Repatriation of Profits and Capital

- 100% Foreign Ownership

- No Currency Restrictions

Rakez

- Free zone based in Ras Al Khaimah

- Up to 5 shareholders

- E-commerce, professional, media, and other types of licenses

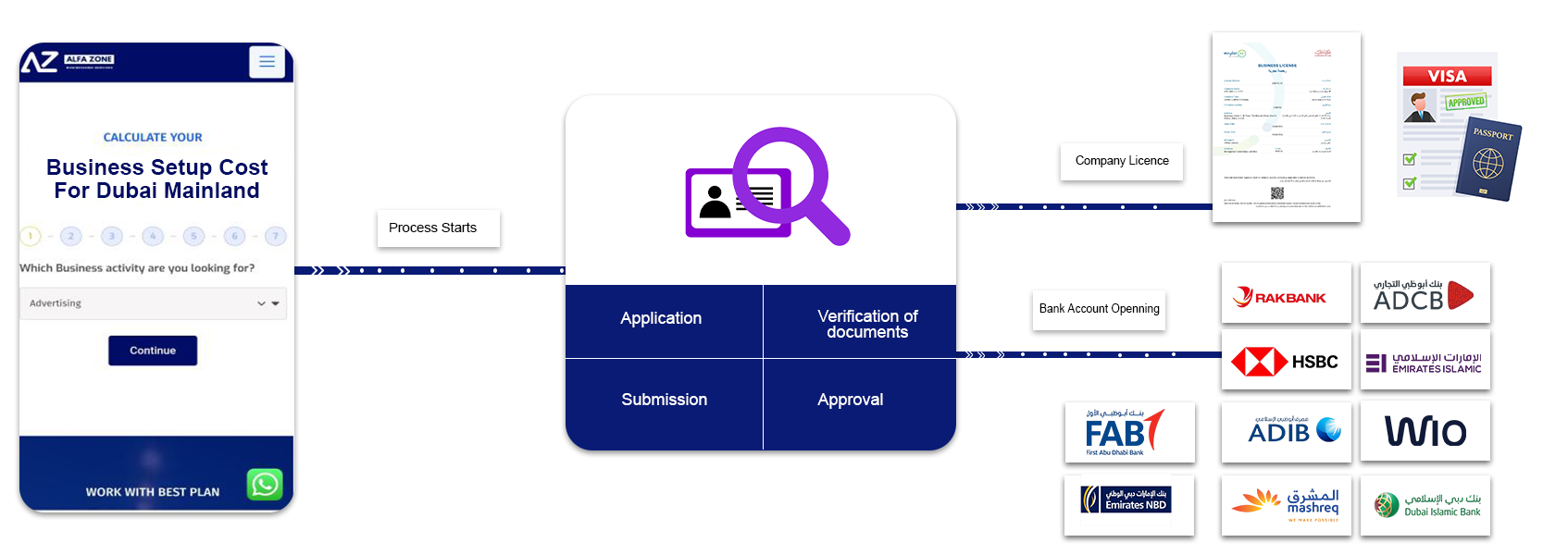

Process

Step by step process of business setup in Dubai

Along with all signed documents, we will submit the filled application for Dubai Mainland business setup.

Your Mainland company trade license dubai gets issued. We will send you a scanned copy to start your business activity. You can now start your business at the Dubai Mainland.

UAE Allows 100% Foreign Ownership of Mainland Companies

Starting a business in Dubai mainland has become significantly more attractive for foreign investors due to recent legislative changes. Previously, foreign investors were required to partner with UAE nationals who had to own at least 51% of the company shares, leaving foreign investors with a maximum of 49%. This minority stake limited their ability to independently manage their companies. Additionally, certain company structures required foreign investors to appoint a local service agent, a UAE national, who would charge fees without owning any shares. These challenges often deterred foreign investors to start a business in Dubai mainland.

However, to attract foreign investment and enhance investor confidence, the United Arab Emirates amended the UAE Commercial Companies Law to allow 100% foreign ownership of onshore companies. This law came into effect on June 1, 2021.

Key Benefits of 100% Foreign Ownership

The new regulations permit 100% foreign ownership for companies engaging in specific business activities listed in the UAE’s ‘positive list,’ which includes more than 1,100 activities across various sectors. The Dubai Economy has provided guidelines to facilitate the full ownership of mainland companies, highlighting several key points:

Eligible Activities: The Dubai Economy supports 100% foreign ownership for numerous commercial and industrial activities. Commercial activities include general trading, contracting, jewelry, gold, pearls, luxury watches, and more. Industrial activities cover metal and construction, flooring, building materials, food production, water production, and paint sectors. Education and hospitality are also included in Dubai’s positive list.

Amendment of Existing Companies: Existing mainland companies in Dubai can reduce the shareholding of an Emirati partner or allow the Emirati partner to resign by amending their company documents through legal channels.

Licensing and Incorporation: The amendment does not alter the processes for licensing, incorporation, and renewal of Dubai mainland companies. These services can still be accessed through the existing channels of the Dubai Economy.

Legal Structures: The new law does not change the existing legal structures of Dubai mainland companies, such as sole establishments, civil companies, and Limited Liability Companies (LLCs). However, it permits transforming an LLC into a one-person company with limited liability under a foreigner’s name.

Foreign Branches: A branch of a foreign company no longer requires an Emirati agent, and existing agents can be removed.

Commercial Agencies: The amendment does not apply to commercial agencies, which remain regulated by separate laws and are owned exclusively by UAE nationals.

Impact and Opportunities

This legal change has led to a surge in foreign investment across the UAE, particularly in Dubai. The attractive tax-free benefits and the ability to fully own a mainland company have prompted many investors to establish their businesses in Dubai. In the first week alone, 59 new Dubai onshore companies were incorporated.

Why Choose Alfa Zone for Mainland Company Formation?

Frequently Asked Questions

Here are the most frequently asked questions regarding Dubai Mainland company formation.

Setting up a business in Dubai mainland offers several advantages, including:

- 100% Foreign Ownership: Recent amendments allow full foreign ownership in various sectors.

- Strategic Location: Access to a vibrant market and connectivity to global trade routes.

- No Corporate Tax: Enjoy tax-free benefits on corporate income.

- Ease of Business: Streamlined procedures for licensing and company formation.

- Flexible Office Solutions: Availability of diverse office spaces, including Flexi Desk, Flexi Office, and Executive Offices.

Dubai mainland offers several types of business licenses tailored to different activities, such as:

- Commercial License: For trading and commercial activities.

- Professional License: For professional services like consultancy.

- Industrial License: For manufacturing and industrial activities.

- Tourism License: For businesses in the tourism sector.

To set up a company in Dubai mainland, the following documents are typically required:

- Passport copies of shareholders and managers

- Visa copy and entry stamp (if applicable)

- No Objection Certificate (NOC) from current sponsor (if applicable)

- Memorandum of Association (MOA)

- Articles of Association (AOA)

- Proof of registered address in Dubai

- Initial approval from the Department of Economic Development (DED)

Yes, as of June 1, 2021, foreign investors can fully own mainland companies in Dubai. This is applicable to businesses engaging in activities listed in the UAE’s 'positive list,' which includes over 1,100 activities across various sectors.

The time required to set up a business in Dubai mainland can vary based on the business type and the completion of required documentation. Generally, it takes between 1 to 3 weeks to complete the registration process, obtain the necessary approvals, and receive the business license. Efficient processing by the Dubai Economy and thorough preparation of documents can expedite the process.

Join 7500+ Happy Customers WorldWide

What Our Valued Customers Say About Us

Excellent

reviews on

Excellent

reviews on

Highly recommend Alphazone Businessmen, especially if you want trustworthy and efficient service!

I highly recommend Alfazone and especially Tonisha to anyone looking for reliable and efficient business setup services in the UAE.

Thankyou ALFA ZONE & specially to SONIYA SHRESTHA.💕💕💕

I would like to recommend Alfa Zone to others and to my friends who need a help to open a trade licence with visa8.purely it is their service but it consist of more clarity and time bound.

The Team Alfa zone is well appreciated due to their response to call and my sincere thanks to Ms Tonisha who assigned to my work.

Really worth going and we can refer to others.in one word 👌 PERFECT.

However, we are deeply disappointed with the service we received after her departure. Unfortunately, the level of support and responsibility significantly declined. Due to the negligence of the current team, especially in handling the deregistration of our business, we faced serious complications that resulted in unexpected costs and stress — all of which could have been avoided with proper follow-up and accountability.

It is extremely disheartening to experience such a drastic drop in service quality. What should have been a straightforward process turned into a frustrating and costly ordeal. We trusted Alfazone to manage our business needs professionally, but sadly, they fell short.

We hope the management takes this feedback seriously and improves their internal processes to prevent other clients from facing similar issues.

A special thanks to Ms. Soniya for her outstanding assistance. Her approachable nature, professionalism, and ability to offer the most suitable options made the process much easier.

She has the patience to explain all our needs any number of times.really Ms Sonia is a asset for your company

I highly recommend this company — an excellent business setup service like no other. I got my Trade License for PRESTIGE PICK GENERAL TRADING FZ-LLC with their help.

Special thanks to Miss Soniya, who has been incredibly supportive from the very beginning and continues to assist me. She expedited both the license and visa application exactly as I requested. Truly professional and efficient service!

A huge thank you to the AlfaZone Dubai team for making my company setup in the UAE such an easy and hassle-free experience. From paperwork to guidance, their support was top-notch. I’m truly grateful for their exceptional service and highly recommend them to anyone looking to establish a business here.

Harima Bizal, a fellow Filipino, guided me every step of the way. Even though I had zero knowledge at the start, it wasn’t a problem at all—she explained everything clearly, was extremely patient, and supported me throughout the whole process. If you're looking for someone reliable, especially if you're Filipino, Harima is the one to go to! Highly recommended!

I would like to specifically commend Ms. Harima for her exceptional assistance. She was not only approachable and easy to deal with, but she also provided the best options tailored to my needs. Her proactive approach in providing prompt updates without needing to ask was particularly impressive.

Thank you for your outstanding service. I look forward to continuing my business relationship with Alfa Zone.

We want to give a special shoutout to Ms. Maricon for her exceptional support. She was proactive in keeping us informed and helped guide us through the entire transition with great care and attention to detail.

In addition, the CEO went above and beyond to help us cancel our old license. Alfa Zone has proven to be a trustworthy and supportive partner, always there when we needed them.

We wholeheartedly recommend Alfa Zone Businessmen Services to anyone looking for assistance with their business setup. Their professionalism, reliability, and excellent communication make them truly outstanding.

A big thank you to Ms. Maricon, Mr Suren, and the entire team for their exceptional service. Great job!

Why Business Setup in UAE?

- Repatriate 100% of your capital and profits to your home country.

- Capitalize on the growing market demand spurred by Expo 2020.

- Enjoy customs duty exemptions on imports and exports.

- Leasing office space might not be necessary, depending on the zone.

- Experience minimal paperwork and auditing requirements.

- Access new markets across the Middle East, Africa, Europe, and Asia.

- Full company ownership & easiest online processes.

Get A Reply In 60 Seconds

Our Network

Authorized Channel Partners

Ready To Start Your Business in Dubai?

Working Hours

Monday – Saturday

9:30am – 6:30pm

©2024. AlfaZone. All Rights Reserved.