Ajman Offshore Company Setup

Lowest Price Guaranteed

Over 12,500 Customers Satisfied

Top Registered Agent with Ajman Free Zone

12,500+

Clients

32,000+

Consultations

5+

About Ajman Offshore Companies

Where are Ajman Offshore Companies Registered?

- Ajman offshore companies are registered with Ajman Free Zone (AFZ), located in the Emirate of Ajman, United Arab Emirates.

- These companies are referred to as International Business Companies (IBCs) or offshore companies under the applicable regulations.

- AFZ operates a state-of-the-art Registry, adhering to international standards and best practices observed by other offshore jurisdictions worldwide.

- Confidentiality: AFZ prioritizes the confidentiality of shareholders, keeping their identities strictly confidential according to the law.

Ajman offshore companies can serve various objectives, including:

- Asset protection

- Trading

- Tax planning

- Real estate holding

- Estate planning

Ajman offshore companies are quick and easy to set up, requiring only one director and one shareholder, who can be the same person.

Main Features of Ajman Offshore Companies:

- Modern Legislation

- Zero Taxes

- 100% Foreign Ownership

- Single or Multiple Directors

- Ownership of Shares in Local Companies

- Zero Paid-Up Capital

- No Accounting and Audit Requirements

- No Nationality Restrictions

- Conduct Business Outside the UAE

- Bank Accounts in the UAE and Abroad

- No Limitation on Capital Expatriation

- Registered Address in the UAE

Activities Not Permitted for Ajman Offshore Companies:

- Financial Services

- Insurance and Re-Insurance

- Media

- Aviation

- Conduct Business with Onshore Companies in the UAE

- Establishing a Branch in the UAE

Activities Allowed for Ajman Offshore Companies:

- International Trade

- Brokerage Activities

- Intellectual Property Rights Holding

- Property Holding in Ajman

- Online Advertising Activities

- Consultancy

- Registration of Ships

- Trading in Stock Markets

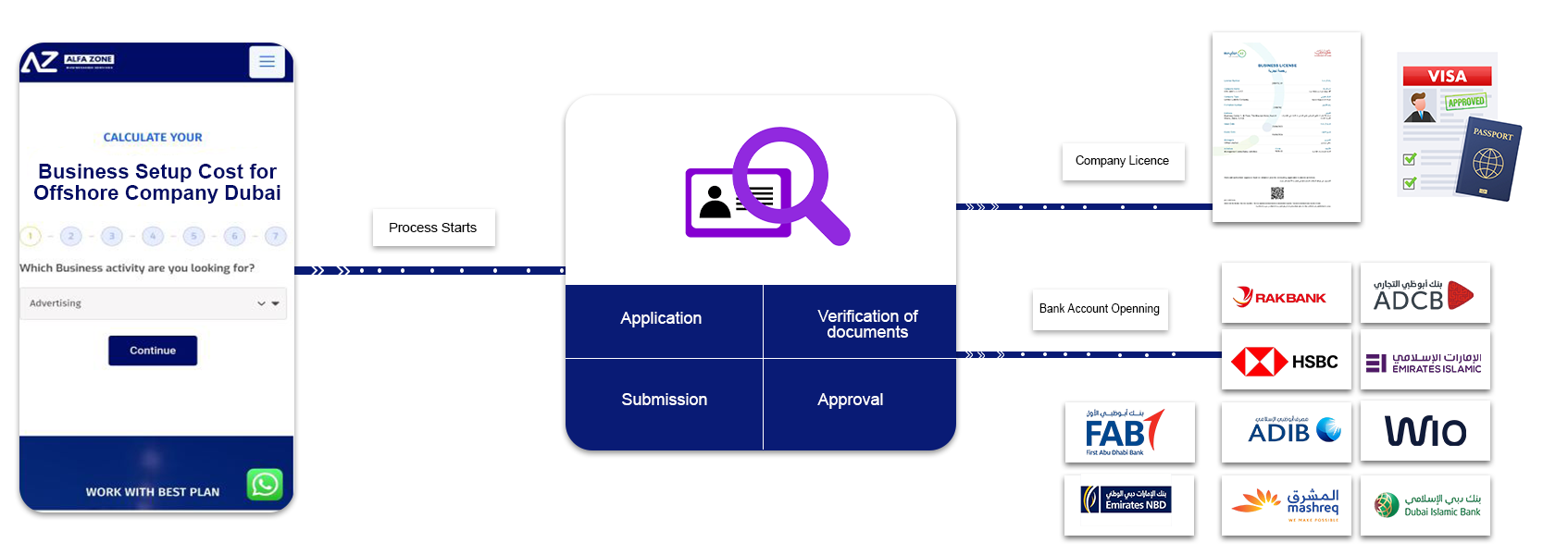

3 Simple Steps

Setting Up your business in Ajman explained in three (3) simple steps

CALCULATE YOUR COST

for Setting up your Offshore Business in Ajman

Our Exclusive Packages

Get in touch with one of our experts to know about the costs of Offshore business setup in Ajman

Other Options

Other Options you maybe interested to set up your business in UAE and Dubai

Meydan Free Zone

- Free zone based in Dubai

- Up to 49 shareholders

- Professional, commercial, and industrial license

Dubai Mainland

- Access to Local Market

- 100% Foreign Ownership

- Flexibility in Office Location

RAK Offshore

- 0% Income Taxes

- International Business Operations

- Business Expansion and Diversification

IFZA

- Free zone based in Dubai

- Up to 3 shareholders

- Professional, commercial, and industrial license

Timeline

Step by step process of offshore company formation in Ajman, UAE

Frequently Asked Questions

Here are the most frequently asked questions regarding Ajman Offshore company formation.

Ajman offshore companies offer several benefits, including zero taxes, 100% foreign ownership, no paid-up capital requirement, no accounting and audit requirements, and confidentiality of shareholders' identities.

The process involves selecting a company name, preparing and submitting the required documents, appointing directors and shareholders, and registering with the Ajman Free Zone Authority. Once approved, the company can start its operations.

No, Ajman offshore companies are not permitted to conduct business within the UAE mainland. They are intended for international business activities, asset protection, and holding investments.

The essential documents include a completed application form, passport copies of directors and shareholders, proof of address, and a detailed business plan. Additional documents may be requested by the Ajman Free Zone Authority.

The setup process for an Ajman offshore company is relatively quick, typically taking between 1 to 3 working days after submitting all required documents and meeting the necessary requirements.

Join 7500+ Happy Customers WorldWide

What Our Valued Customers Say About Us

Excellent

reviews on

Excellent

reviews on

Why Business Setup in UAE?

Maximize your earnings with the UAE’s 0% income tax policy.

- Repatriate 100% of your capital and profits to your home country.

- Capitalize on the growing market demand spurred by Expo 2020.

- Enjoy customs duty exemptions on imports and exports.

- Leasing office space might not be necessary, depending on the zone.

- Experience minimal paperwork and auditing requirements.

- Access new markets across the Middle East, Africa, Europe, and Asia.

- Full company ownership & easiest online processes.

Get A Reply In 60 Seconds

Our Network

Authorized Channel Partners